Important Tax Deadlines & Events (Updated For 2025)

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

Discover the suggested reimbursement rates for employees’ private mileage using their company car.

Now is the perfect time to review your finances and make sure you’re making the most of available tax reliefs and allowances.

It is that time of year again for staff parties and annual functions, so it is important to make sure you record it properly.

At this time of year, we think about New Year’s resolutions. It is also a good time to start planning your

130% super-deduction for investing in new plant continues: Many businesses may have been too short of cash to take advantage of the new super-deduction for investing in new plant in 2021 but may be more confident about investing in 2022.

Second hand plant and machinery does not qualify for the 130% super-deduction but would still qualify for the 100% Annual Investment Allowance (AIA).

In his Spring 2021 Budget the Chancellor announced that there would be 8 “Freeports” in England with generous tax breaks to encourage businesses to set up and invest in those areas.

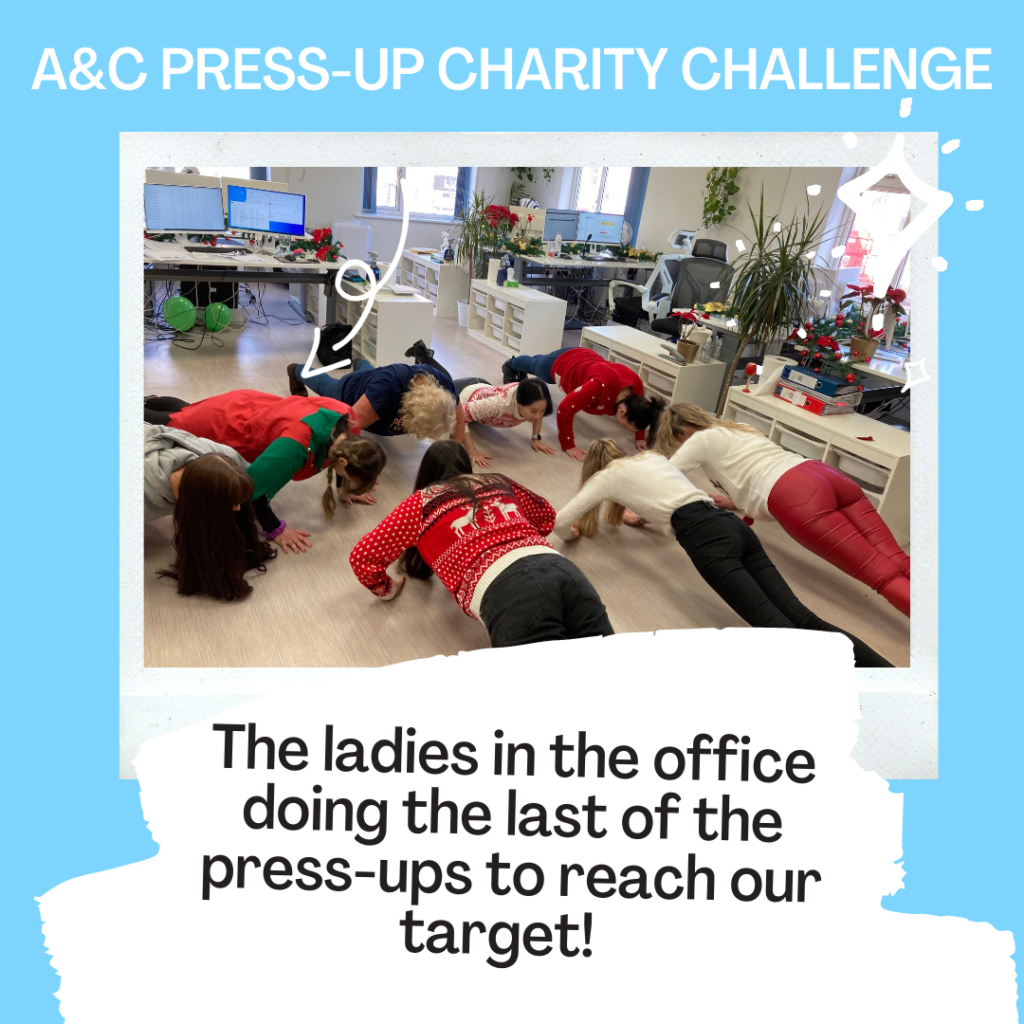

Firstly, we would like to say a big thank you to all clients for your donations so far. We are delighted to confirm we have now completed our 20,000 press-ups for Royal Manchester Children’s Hospital and we are so close to reaching our target of £3000!

A&C’s Christmas Jumper day has been a great success! The team at A&C Chartered Accountants have had a fantastic day on 10th December 2021, to help raise money for the Royal Manchester Children’s Hospital Charity

The latest version of the CT600 Corporation Tax Return requires companies to report CJRS furlough payments received and the amounts

Remember that certain gifts to staff at Christmas are also tax free if structured correctly. Employers are allowed to provide their directors and employees with certain “trivial” benefits in kind tax free.

Where possible taxpayers should “Gift Aid” any payments to charity to provide a further benefit to the charity.

Another tax planning strategy that is still available despite rumours that it would be closed in the Budget was the CGT hold over relief when assets are transferred into or out of a trust.

One tax planning opportunity that many thought the chancellor might restrict was the exemption from inheritance tax for regular gifts out of an individual’s income.

Many were expecting the chancellor to announce changes to inheritance tax (IHT) in his Autumn Budget, However, like capital gains tax (CGT),

This time of year we need to consider gift giving and tax. It is easy during the Christmas period to to be generous, but most of us feel we are quite generous enough to the taxman during the rest of the year.

In 4 weeks time, it is Christmas Jumper day! In the 20 working days leading up to the day our team will be taking on the challenge of 20,000 press ups

As we come to the end of 2021, its time to start thinking about the budget for next year. One thing is certain – uncertainty.

Business planning and budgeting have become increasingly complex in today’s uncertain and volatile environment. Firms have had to adapt and become more agile in order to react quickly to changing market conditions and budgets should be created with this in mind.

We have compiled a list of tax-free benefits and perks you can provide an employee. These perks are completely free of tax and National Insurance Contributions (NICs).

With more employees going back to work after the end of CJRS furlough support, they need to start thinking about childcare if they have children.

Having listened to stakeholder feedback from businesses and the accounting profession, the government have announced that they will introduce Making Tax Digital (MTD)

The capital allowance legislation specifically denies tax relief for plant and machinery installed in a dwelling house. However, plant and machinery installed in the common areas of blocks of flats such as hallways, stairs and lift shafts would qualify as the flats themselves are the dwellings not the building as a whole.

The Prime Minister announced on 7th September that the government will introduce a new 1.25% Levy to provide an extra £12 bn a year to support the NHS and social care.

If you are notifying HMRC of a decision to opt to tax land and buildings, you are normally required to notify HMRC within 30 days. The 30 day deadline was temporarily extended to 90 days to help businesses and agents during