Important Tax Deadlines & Events (Updated For 2025)

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

It is crucial to stay on top of key tax dates to keep your financial affairs in order. Here’s a friendly reminder of the important tax deadlines this year.

Discover the suggested reimbursement rates for employees’ private mileage using their company car.

Now is the perfect time to review your finances and make sure you’re making the most of available tax reliefs and allowances.

It is that time of year again for staff parties and annual functions, so it is important to make sure you record it properly.

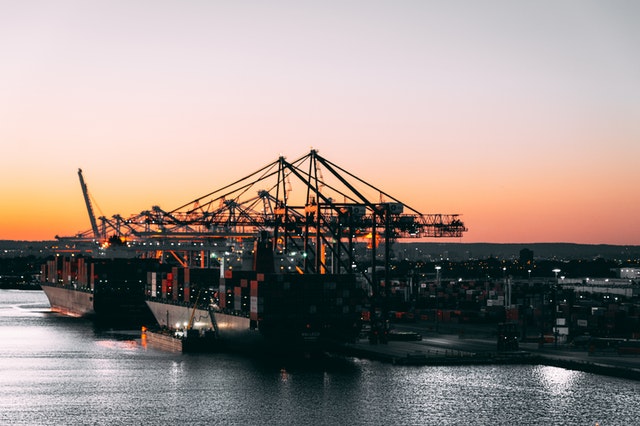

In his Spring 2021 Budget the Chancellor announced that there would be 8 “Freeports” in England with generous tax breaks to encourage businesses to set up and invest in those areas.

Remember that certain gifts to staff at Christmas are also tax free if structured correctly. Employers are allowed to provide their directors and employees with certain “trivial” benefits in kind tax free.

Where possible taxpayers should “Gift Aid” any payments to charity to provide a further benefit to the charity.

Many were expecting the chancellor to announce changes to inheritance tax (IHT) in his Autumn Budget, However, like capital gains tax (CGT),

This time of year we need to consider gift giving and tax. It is easy during the Christmas period to to be generous, but most of us feel we are quite generous enough to the taxman during the rest of the year.

With more employees going back to work after the end of CJRS furlough support, they need to start thinking about childcare if they have children.

The temporary 5% VAT rate that has applied to supplies made in the tourism and hospitality sector since the start of the pandemic comes to an end at the end of September.

The Government are pulling the plug on support to employers for furloughed staff at the end of September as they anticipate that the economy will be back to normal by October.

HMRC suggest organisations use their Check Employment Status for Tax (CEST) tool on their website to check the worker’s status, although that is not obligatory.

Where a company makes a trading loss of no more than £200,000 in an accounting period it is now possible to claim relief for that loss even though the corporation tax return CT600 has not been submitted.

HMRC are currently attacking a marketed tax avoidance scheme using unfunded pension arrangements to avoid Corporation Tax,

Pension contributions to approved pension funds on behalf of employees and directors continue to be a tax-free benefit provided the annual input limit is not breached.

The numerous changes in the method of calculating CJRS furlough grants will no doubt have resulted in errors by some employers.

Despite the coronavirus lockdowns HMRC still expect P11d forms reporting expenses and benefits to be submitted by the normal 6 July deadline.

Check that your shares qualify for CGT business asset disposal relief: A recent case before the tax tribunal has confirmed that all of a company’s shares are ordinary shares except those that carry a fixed rate of return.

Another consequence of the lockdown periods is that employees may have driven fewer private miles in their company cars, particularly where they have not been driving to the office.

P11d forms reporting benefits in kind provided to employees and directors need to be submitted to HMRC by 6 July.

HMRC are urging businesses to look out for the use of mini-umbrella companies (MUCs) to pay contractors supplying their labour via agencies and other intermediaries.

Please note that HMRC make regular checks on companies making a claim under the Coronavirus Job Retention Scheme. If you make a claim that is fraudulent i.e. make a claim for a period whilst actually working, you will be required to pay back all grants received under the scheme and could be fined.

In March 2021, the Chancellor announced in the budget a new “Super Deduction” Annual Investment Allowance. This means that from April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets

Government have announced a one-year exemption from paying employers national insurance contributions (NICs) where military veterans are recruited by civilian employers.